-

MINISTRY

-

FUNCTIONS

- Economic Policy

-

Agriculture

- Agrarian policy

- Agrarian policy Agrarian policy

- Agro-processing

- Agro-processing Agro-processing

- Animal breeding

- Animal breeding Animal breeding

- Veterinary medicine

- Veterinary medicine Veterinary medicine

- Plant cultivation

- Plant cultivation Plant cultivation

- Phytosanitary

- Phytosanitary Phytosanitary

- Agricultural cooperation

- Agricultural cooperation Agricultural cooperation

- Fish farming

- Fish farming Fish farming

- Organic agriculture

- Organic agriculture Organic agriculture

- Public Investment

- Investment Policy

- Free Economic Zones

- Industrial Policy

- Business Environment

- Small and medium-sized entrepreneurship

- International Cooperation

- Armenia - European Union

- Armenia-EAEU

- Armenia - WTO

- Trade and Market Regulation

- Tourism

- Capital market

- Quality infrastructure

- Сtrategic sectors

- Licensing, permits

- Intellectual Property

-

PROJECTS

- State Support Programs for Agriculture

- Economy modernization program

- Infrastructure for investment assistance event

- CARMAC II Project

- State support program for issuance and rating

- The state support program for commercial companies engaged in the production of economically complex products

- Fee and cost reimbursement program for drug registrations and re-registration examinations

- Program for Compensation of Costs of Clinical Trials and Bioequivalence Studies in the Republic of Armenia

- International cooperation projects

-

INFORMATION

-

MEDIA CENTER

- CONTACTS

- Economic Policy

- Agriculture

- Public Investment

- Investment Policy

- Free Economic Zones

- Industrial Policy

- Business Environment

- State Support Programs for Agriculture

- Economy modernization program

- Infrastructure for investment assistance event

- CARMAC II Project

- State support program for issuance and rating

- The state support program for commercial companies engaged in the production of economically complex products

- Fee and cost reimbursement program for drug registrations and re-registration examinations

- Program for Compensation of Costs of Clinical Trials and Bioequivalence Studies in the Republic of Armenia

- International cooperation projects

Home

FUNCTIONS

BUSINESS ENVIRONMENT IMPROVEMENT

Improving the business and investment environment is one of the key conditions for the economic development of the Republic of Armenia. To achieve this, the Government of RA aims to create a simple, transparent, and cost-efficient framework of state regulations, services, and administrative procedures for business activity, ensure equal competitive conditions, develop market infrastructure that supports entrepreneurship, and implement a balanced tax and customs policy.

To implement reforms in this area, the Government has adopted 12 programs aimed at improving the business environment, through the mentioned decrees (RA Government Decree No. 775 of 2008; No. 97-N of 2010; No. 1768 of 2010; No. 1930-N of 2011; No. 240-A of 2013; No. 258-A of 2014; No. 265-N of 2015; No. 110-A of 2016; No. 24 of 2017; No. 477-A of 2018; No. 560-L of 2019; and No. 246-L of 2020).

WORLD BANK’S BUSINESS READY (B-READY) REPORT

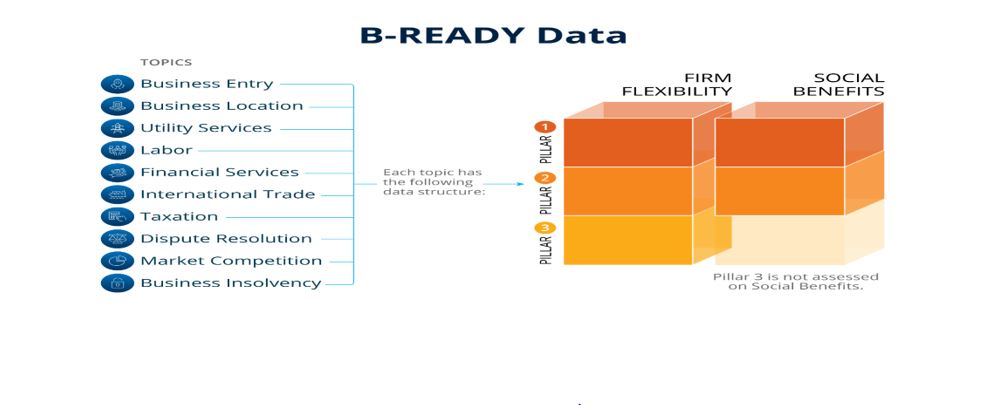

The World Bank’s Business Ready (B-READY) report evaluates regulations that directly affect the business environment, providing a framework for international comparisons across 101 economies.

ARMENIA IN B-READY 2025

According to the B-READY 2025 ranking report published by the World Bank on December 29, 2025, Armenia achieved above-average results, placing it among countries in the Europe and Central Asia region with the most stable business environments.

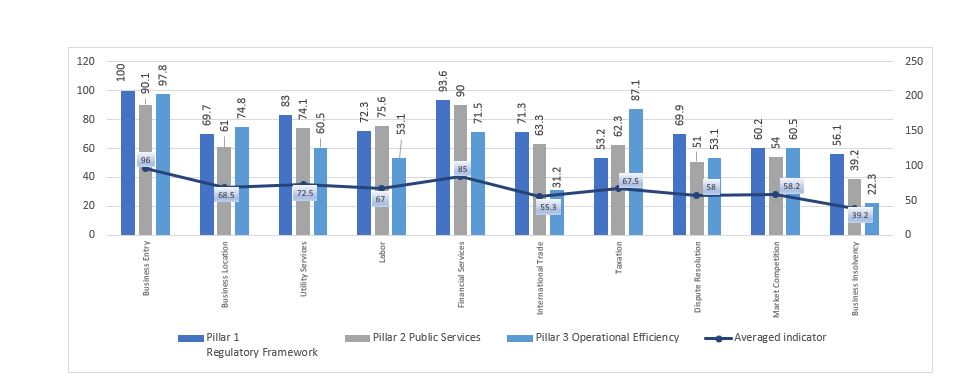

Overall, Armenia scored 66.7 points, exceeding the average score of the 101 evaluated countries (60.1 points) by 6.6 points. This result confirms Armenia’s position as a dynamically developing economy with an above-average business environment.

Armenia recorded its highest score in the “Starting a Business” category, achieving 96 points, which secured a leading position among the 101 countries.

Other high-performing areas include:

- Financial Services – 85.04 points

- Utilities – 72.52 points

- Business Location – 68.49 points

- Taxation – 67.50 points

- Labor – 67.0 points

In these areas, Armenia exceeded global averages, ranking among countries with high evaluation scores.

Despite generally positive assessments, the report highlights potential areas for further improvement:

- Market Competition – 58.21 points

- Dispute Resolution – 57.96 points

- International Trade – 55.26 points

- Business Insolvency – 39.17 points

-

Hot line

* Hot line operates on weekdays (Monday-Friday) from 09:00 to 18:00.

- BUSINESS ENVIRONMENT

- (+374 11) 597 539

- TOURISM

- (+374 11) 597 157

- QUALITY INFRASTRUCTURES

- (+374 11) 597 167

- PRODUCT LABORATORY TESTING

- (+374 11) 597 166